Our selected articles

Read our latest insights on FinTech, private debt, finance and innovation

Securitisation: active management option to boost Luxembourg hub

The overhaul of Luxembourg’s securitisation laws introduced a number of changes, notably allowing for active management and a broader scope for refinancing. Holger von Keutz, securitisation leader at PwC Luxembourg, believes that the amended law will increase the attractiveness of Luxembourg as a securitisation [...]

Originator Spotlight/Lenderwize

A fast-growing trade finance platform, Lenderwize specialises in invoice financing in the digital economy. Currently its platform provides its services to the telecommunications industry, financing invoices for the voice telecom wholesale industry, the SMS industry, the data industry, and the direct carrier billing industry. Lawrence Gilioli, founder at Lenderwize, spoke with Brian Kane, Director Capital Markets and Origination at CrossLend, and explained how its tech-driven platform can [...]

Digital lending emerges as an important sub-segment of private debt

Amid increasing breadth within the private debt asset class, specialised investors can allocate capital to sub segments in [...]

6 major changes in new Luxembourg securitisation law

Securitisation is an important and flexible structure which is used by many investors. In this context, Luxembourg [...]

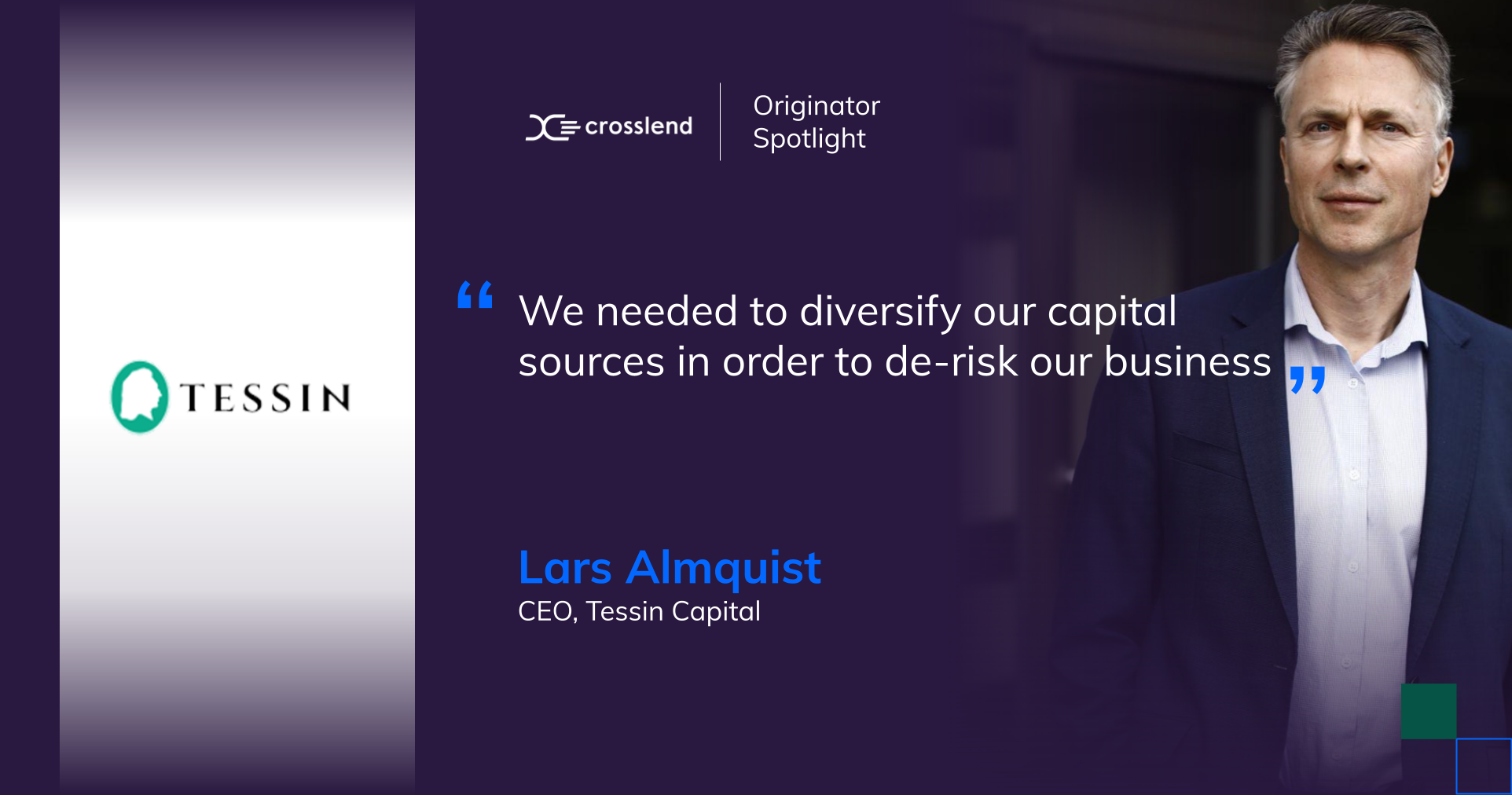

Originator Spotlight/Tessin

Founded in Stockholm, Sweden in 2014, Tessin AB offers construction and bridge loans to property companies and [...]

Unpacking Luxembourg’s Amended Securitisation Law

A web session with CrossLend, PwC and Allen & Overy With Luxembourg as one of the main [...]

Securitisation 2.0 in Luxembourg

CrossLend’s resident expert on securitisations, Head of Legal Antonine Sanchez, talks about the potential advantages of a securitisation [...]

Due diligence on digital lenders

While investing in the originations of digital lenders can be attractive to investors, a robust and detailed [...]

The evolution of Bank-FinTech partnerships

Industry veteran Kate Pohl reflects on the maturation of the relationship between FinTechs and banks. She looks [...]

The growth of private debt in Europe has its origins in the Global Financial Crisis

Brian Kane, Director of Capital Markets and Origination at CrossLend, spent the best part of seventeen years [...]

Making your time matter with Elaine

Hi Elaine, can you please introduce yourself? Where are you from, and how did you come to [...]

Will embedded finance shake up the B2B sector?

Consumers have eagerly taken to the introduction of embedded finance, including buy now pay later (BNPL). Experts [...]

Originator Spotlight/ creditshelf

Founded in 2014, creditshelf is a lending platform focused on the German Mittelstand, supporting the capital needs [...]

5 ways inflation will impact private debt

The rise of inflation as an economic force has complicated the outlook for investors, many of whom have [...]

Risk scoring: How investors can assess digital lenders

Risk scoring is at the heart of many lending approaches. The regulations that govern digital lending are typically [...]

Insights: Recap of First Presence Week in Berlin

At the end of March, CrossLend employees from six different offices - Berlin, Frankfurt, Vienna, London, Lisbon, Luxembourg [...]

Make Your Time Matter With Daniel

From working student to data scientist Hi Daniel, please introduce yourself and how you came to work at [...]

Digital lenders set to see spike in demand from businesses as Covid guarantee scheme loans expire

With European government aid schemes coming to an end, digital lenders have a lucrative opportunity to write [...]

Real estate: Germany’s structural funding gap and demand for mezzanine lending

Demand for mezzanine financing among German real estate developers has grown in recent years as banks have lowered [...]

The role of private debt as a portfolio diversifier for institutional investors

Amid the low yields on offer on traditional fixed-income assets, private debt is emerging as a strong [...]

Originator Spotlight/Mozzeno

One of Belgium’s largest peer-to-peer lending platforms, mozzeno, saw solid growth in 2021, with origination volumes exceeding [...]

Private debt ESG investing meets digital debt technology

Well-known in the public debt markets, Environmental, Social, and Governance (ESG) investing in private debt is attractive [...]

Building industry standards for lending platforms in Germany

Alternative lenders are playing an increasingly important economic role in funding businesses, in Germany and across Europe. [...]

Data and analytics can give private debt funds an edge in the race to deploy capital

Investment funds specialised in investing in private debt can be an attractive route to gain exposure to this [...]

Making Your Time Matter With Lasma

Lasma Pakne is a UI/UX designer with CrossLend Hi Lasma, please introduce yourself and tell us what you [...]

Originator Spotlight/ Finora Capital (Lithuania)

Based in Vilnius, Lithuania, Finora Capital is a fast growing digital lender focused on providing working capital [...]

Originator Spotlight/ Fellow Finance

In the landscape of alternative lenders in Europe, Fellow Finance is a notable success story. Founded in [...]

BNPL – what’s next for the payment alternative that’s taken the world by storm?

Buy now pay later is a relatively simple concept and not entirely new - but it’s seen [...]

Making Your Time Matter with Holger

Name: Holger Lösken Title: Senior Web Engineer How long have you been with CrossLend? What do you [...]

‘As a Service’ companies are growing fast – and so are the demands for debt financing

Businesses and consumers alike are drawn to the convenience and flexibility offered by ‘as a Service’ companies, [...]

2021 Recap – Major Trends in Private Debt

2021 was an eventful year for private debt in Europe. The enduring low-yield environment saw continued demand [...]

Originator Spotlight/ Nestr Smart Finance

Dutch originator Nestr Smart Finance has distinguished itself by offering faster loan approval than mainstream banks. Nestr’s [...]

Transforming the complexity of Europe’s fragmented lending economy into the asset of strong diversification

Europe is simultaneously diverse and unified. We witness the trade-offs of this dichotomy every day. The beauty [...]

How growth success factors have changed over time for European lending platforms

Over the past few years, we have engaged with more than 70 credit platforms. We have drawn [...]

The challenges of investing in private debt – a US / Europe comparison

From time to time, I receive newsletter emails with the headline “X invested Y million in Z”. [...]

Legal newsflash – Luxembourg’s securitisation regime is to be modernised

The long-awaited draft bill amending Luxembourg's 2004 securitisation law (the “Bill”) was submitted to the Luxembourg Parliament [...]

Challenges that alternative lenders and marketplaces face when connecting with experienced capital markets investors

First of all, I need to confess something: While CrossLend is a capital markets technology provider today, [...]

The rising importance of private debt as an asset class

There is an academic and slightly boring way of lecturing about private debt as an asset class. [...]

Reflecting on the regulatory framework for securitisation

At the end of September, the European Commission released its latest action plan for the Capital Markets [...]

Verbriefung von Forderungen wird für Banken und andere Originatoren effizienter

TXS und CrossLend vereinbaren Kooperation. Um ihre Bilanz zu entlasten, stellen Banken und andere Originatoren Forderungen zusammen, [...]

Rethinking the nature of financial systems as complex systems

The twentieth century brought a great deal of changes to the financial industry. It saw shifts in [...]

The potential of private credit as an asset class in the Government’s economic plan

How CrossLend’s digital debt marketplace could efficiently fund key investment objectives outlined in the Irish Programme for [...]

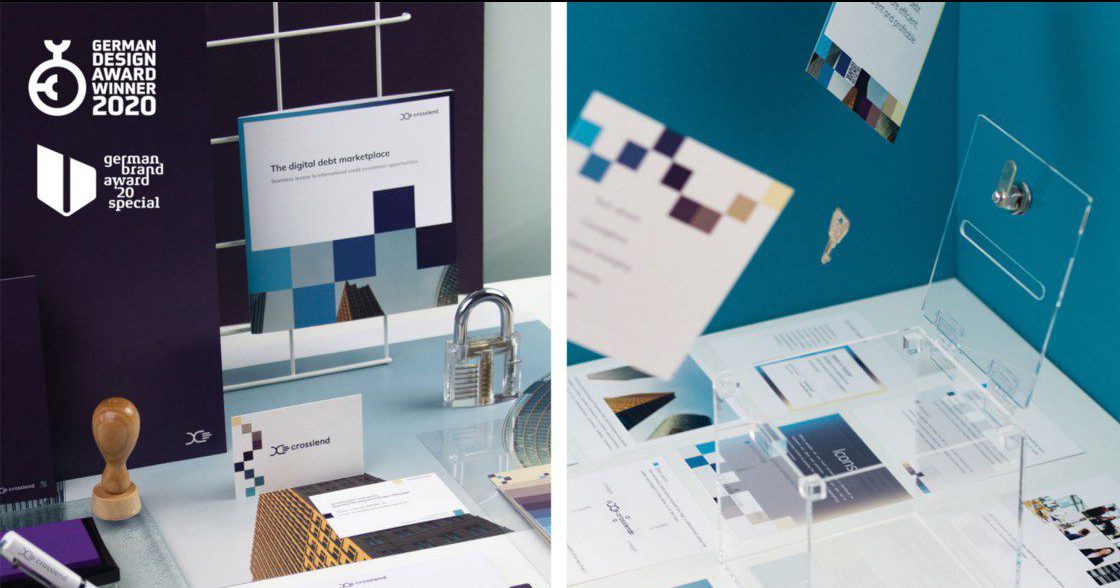

Fintechs disrupt once again Contemporary brand design proves it’s more than just another pretty face

This year, CrossLend was honoured to receive two awards: German Design Award for “Excellent Communications Design — [...]

What’s the outlook for UK non-bank lenders?

COVID-19 has been in the UK for at least six months and its influence doesn’t appear to be [...]

Supporting SME Funding as part of the COVID-19 economic recovery

Over the past few months, in the face of a global pandemic, Ireland’s health care systems and [...]