Data and analytics can give private debt funds an edge in the race to deploy capital

Investment funds specialised in investing in private debt can be an attractive route to gain exposure to this alternative asset class. Yet data on the volumes of undeployed capital – dry powder – in the private debt fund segment globally suggest strong competition for attractive deals. When it comes to investing in digital lending platforms in Europe, using data and analytics to scope opportunities and lower operational costs can result in faster deployment across a more diverse range of platforms, giving private debt funds an edge in the race to deploy capital.

As European banks have retrenched from lending in diverse segments including consumer finance, SME lending, and working capital loans, alternative digital lenders have stepped in to fill the gap. That’s part of a global trend: worldwide alternative finance volumes (excluding China) grew from $60 billion in 2017 to $113 billion in 2020, according to the 2nd Global Alternative Finance Benchmarking Study.

With their emphasis on digital presence, new customer acquisition channels such as embedded finance, and even performance marketing, digital lenders appear to have the upper hand over traditional banks when it comes to customer growth.

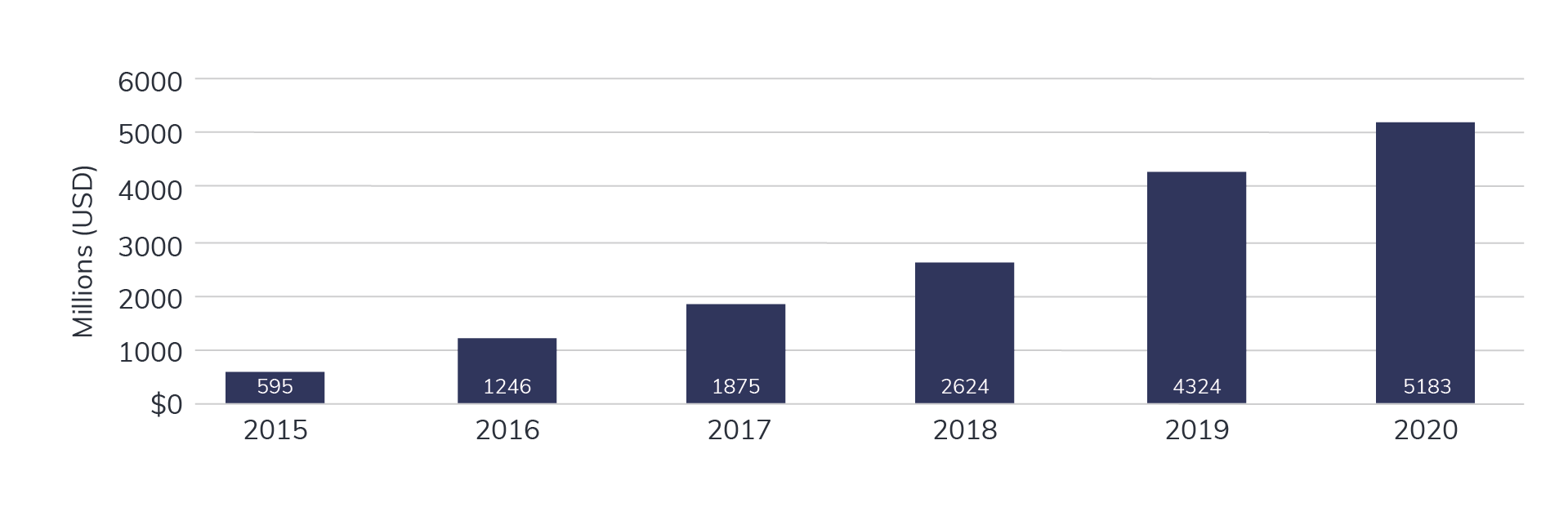

In the sphere of business lending, origination volumes by alternative lenders have risen nearly ten-fold from 2015 through to 2020, with volumes in Europe (excluding the UK) rising from $595 million to $5.2 billion across this period. This signals how important non-bank lending now is to businesses, demonstrating its contributions to economic growth and employment.

Total alternative finance funding for European businesses, excluding UK

Source: ‘The 2nd Global Alternative Finance Benchmarking Study’, University of Cambridge, published 2021

But in an environment of rising origination volumes, the limited availability of low-cost, reliable funding is often the main constraint upon an alternative lender’s ability to grow. Most non-bank lenders are continually looking to broaden their funding base and decrease their funding costs in order to stay on a path of growth.

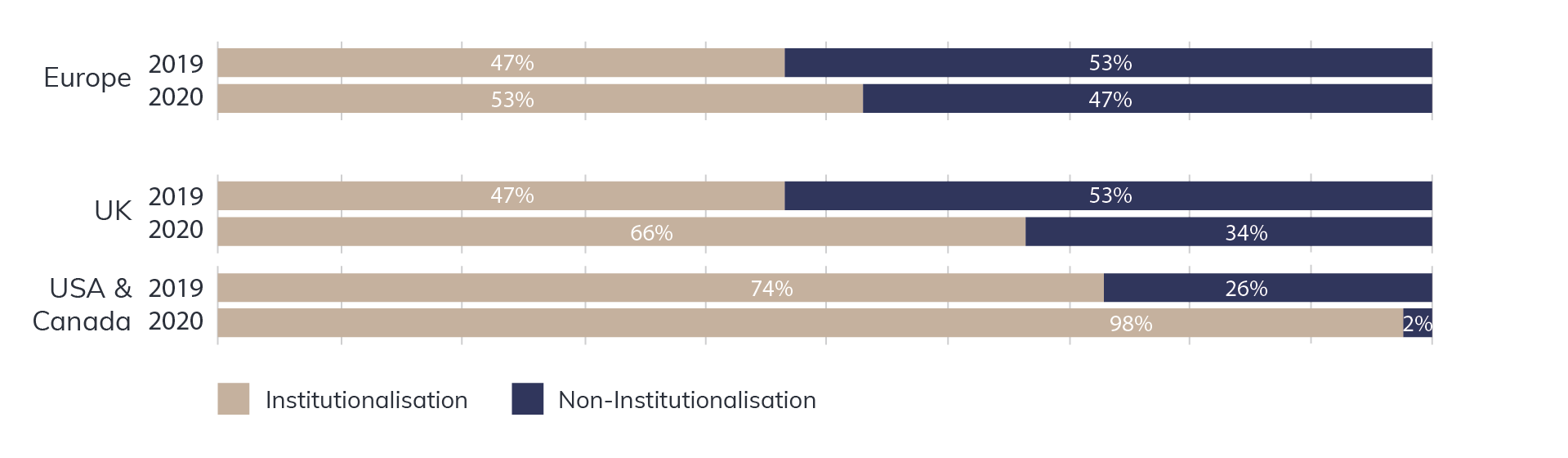

For institutional investors, funding or refinancing non-bank originators can be an attractive source of returns, pegged to appropriate risk profiles. Globally, the institutionalisation of digital lenders is on the rise. Yet Europe – especially its smaller markets – lags behind the United States of America and the United Kingdom.

In part, this is because of the large number of individual alternative lending platforms in Europe – there are thought to be more than 700 of them – compared to fewer than 100 in the US and Canada and fewer than 100 in the UK as well. Given that the overall European origination volume is lower than both the US and the UK, that means comparatively low average origination volumes across digital lending platforms in Europe.

From one perspective, Europe’s market breadth can be healthy, representing a highly diverse sector of lenders; many are specialised in market niches, including SME working capital, unsecured lending, factoring, trade finance, real estate, and infrastructure debt, as well as consumer finance. Consumer finance includes fast growing areas in embedded finance such as buy now pay later.

For investors, this degree of fragmentation can create favourable conditions for diversification across portfolios within European private debt.

However, the downside is that individual investors in European private debt are faced with the difficult and time-consuming task of assessing the market to find platforms to invest in; even then, they may need to select several platforms to meet their minimum capital deployment thresholds.

It’s hardly surprising that gaining exposure to an alternative asset class like private debt is less straightforward than investing in public markets. Obstacles like struggling to identify suitable lenders mean that specialised funds are the preferred route to private debt for many investors.

“All the work of screening the market, of analysing each originator, and setting the proposed allocations is hugely time demanding and energy consuming. For an investor to reach high diversification across geography, maturities, and types of underlying assets, it’s much easier for them to just go to a specialised asset manager that can build a portfolio like this,” says Victor Marques, Digital Lending Investment Specialist at CrossLend, based in the Lisbon office.

“Fund managers must be in constant contact with the market. They have to be aware of what is happening and be able to identify specific opportunities because there are a lot of players, but not everyone is going to be sustainable in the medium to long term,” he notes.

Institutionalisation of alternative financing platforms by region

Source: ‘The 2nd Global Alternative Finance Benchmarking Study’, University of Cambridge, published 2021

If investing via a fund, investors can rely on fund managers to source deals, carry out due diligence and reporting, and to keep abreast of market news. A fund structure may also be more attractive than direct investing from a compliance and reporting perspective compared with investing directly in loans, although using digital notes such as through CrossLend’s securitisation as a service can also mitigate some of the operational challenges of direct investing.

Even then, specialised private debt funds can require significant head counts in order to source deals. Meanwhile, data on the volumes of undeployed capital – commonly referred to as dry powder – in the private debt fund segment globally suggest strong competition for attractive deals. “There may be diverse reasons to retain dry powder – for example, investors in distressed debt may be waiting patiently for market turmoil – but fundamentally, high levels of dry powder point to difficulties in sourcing deals that offer attractive yields,” says Pedro Carvalheiro, Country Head: Portugal at CrossLend.

“Yields have been so low, and many assets that are not negatively yielding have seen their pricing completely distorted,” says Carvalheiro. “Investors such as banks, pension plans, and insurance companies are seeking different asset classes.”

Slow deployment can affect investor returns if they’re paying management fees on undeployed cash, not to mention the opportunity cost.

One solution is to rely more heavily on data-driven asset sourcing to improve results. “A data-driven approach, along with the standardisation of information, makes it possible to analyse not only the large platforms, but also the smaller ones. A best-in-class selection opens up access to a broader group of asset creators,” says Marco Hinz, Chief Operating Officer at CrossLend.

By reducing the costs of due diligence and ongoing monitoring, data-driven asset sourcing opens up investment opportunities in smaller ticket sizes (whether for a fund manager or direct investment, such as via the CrossLend Marketplace). This way, operational costs, such as manually collecting data, crunching numbers, along with due diligence, which may ordinarily preclude investment in smaller platforms, can be reduced.

Where high minimum ticket sizes exclude investors from investing in a cross-section of the digital lending landscape in Europe – especially in smaller markets – this can ultimately shrink their investable universe and reduce opportunities for diversification, especially geographically.

“As opportunities in the private debt sector in Europe grow, investors are coming to realise that they – or their investment funds – need an edge in the race to deploy, given the strong competition for any deals offering attractive yield with appropriate risk. At CrossLend, we see data-driven approaches along with the standardisation of data – such as is offered through our platform – as a highly effective tool to discover and screen new deals, allowing for the effective and diversified deployment of capital,” concludes Hinz.

Related articles

Securitisation: active management option to boost Luxembourg hub

The overhaul of Luxembourg’s securitisation laws introduced a number of changes, notably allowing for active management and a broader [...]

Originator Spotlight/Lenderwize

A fast-growing trade finance platform, Lenderwize specialises in invoice financing in the digital economy. Currently its platform provides its [...]

Digital lending emerges as an important sub-segment of private debt

Amid increasing breadth within the private debt asset class, specialised investors can allocate capital to sub segments in a bid [...]