The potential of private credit as an asset class in the Government’s economic plan

How CrossLend’s digital debt marketplace could efficiently fund key investment objectives outlined in the Irish Programme for Government 2020 by channeling institutional private debt.

The government coalition parties (Fianna Fáil, Fine Gael and the Green Party) have now put in place their programme for Government, implementation of which will take the form of ‘combo punch’ of measures starting with the July stimulus and rolling on to a National Economic Plan, in conjunction with the Autumn budget and integration with the EU Recovery Fund.

A Progressive blueprint for environmental led economic growth

With the runway in place, success is now down to strategic execution.

In and of itself the program is ambitious, promising a government ‘of enterprise’ bringing together the ‘best thinking from three distinct parties’ to address the national and international challenges facing the country.

Top priorities from the finance side include;

– The delivery of social and affordable housing

– Increased state involvement in the provision of credit to SME’s via the Credit Guarantee Scheme

– Prioritising green finance Strategies that are developed in line with climate targets

– Expanding the activities of Credit Unions, which are keen to offer a wider range of products to their customer base — mortgages, SME loans etc.

– Increasing the availability of long-term fixed rate mortgages and considering further state-backed mortgages to support affordable home ownership

How should this be delivered?

What is really interesting about the areas that the government has identified to support is that they generally fall under the Asset Class known as Private Credit.

Born out of a strategic repositioning post-financial crisis period, and spurred on by the withdrawal of banks from traditional lending, private credit has grown considerably as an asset class in the last 10 years.

Today it covers a broad spectrum of asset classes, including (but not limited to): mid-market loans,CRE loans, infrastructure financing, and increasingly, more granular asset classes such as mortgages, SME, auto loans, and short-term invoice / trade finance receivables.

Investors fall into a number of categories — fixed income credit, private debt, private credit, real assets, hard assets, illiquids and secure income return.

Many globally institutional investors in search of stable, defensive and risk-adjusted returns have teams and strategies dedicated to sourcing and funding these opportunities.

Social housing, long-term residential mortgages, Green and impact investing are all maturing strategies within an increasingly digitised technology driven institutional investor community, seeking to deploy funds in a structured and targeted way.

In the Netherlands we have seen a complete shake up of the mortgage market, whereby pension funds and insurance companies increasingly fund a higher proportion of owner-occupied mortgage origination.

Asset manager signatories with the Principles for Responsible Investment (PRI) have over $100 trillion in assets under management, aligned to promote ESG and responsible investment principles. Many of these firms have Private Credit Strategy investment mandates.

Riding the slipstream

It’s time now for the Irish government to make a quantum leap in terms of positioning Irish investment opportunities ahead of this private credit ‘curve’.

FDI has been great for the economy, but the next policy imperative is the digitisation of the key vertical asset classes within the economy (notably those identified in the Programme for Government), as well as the creation of a scalable institutional funding structure that will allow global investors to gain exposure to these assets in the real economy.

At a national level the government needs to have a more attuned understanding of the global pockets of liquidity available and how to harness them.

When trying to position Ireland on the radar of international investors we often hear that: there is a lack of paper to invest in; few comparisons to benchmark deals off; limited liquidity; and lack of data / track record upon which investor decisions can be based. All of which results in less capital willing to consider Ireland and consequently, higher funding costs.

CrossLend is the solution

The CrossLend marketplace and infrastructure is one solution that could assist the government to execute on their progressive blueprint for environmentally-led economic growth.

Infrastructure

We offer a technology-driven platform, connecting loan originators and institutional investors across borders and asset classes

Transformation

We make loans investable for institutional investors by transforming them into different capital markets instruments

Standardisation

We provide standardised loan data, allowing for more transparency, better comparability and convenient reporting.

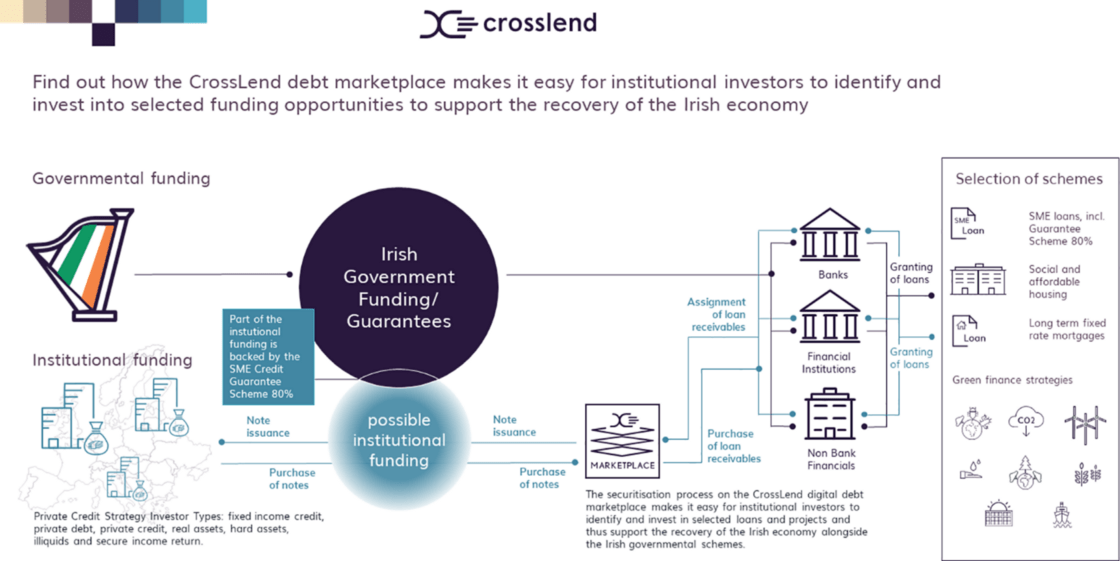

The below infographic illustrates how institutional investors could invest in selected loans via the CrossLend marketplace and thus support the recovery of the Irish economy alongside the Irish governmental schemes.

Conclusion

By creating the right connectivity for Private Credit investors to deploy funds directly into housing, SME’s and Green finance proposals, the government will go a long way to attracting cheaper institutional capital to sit alongside Irish domestic investors.

Related articles

Securitisation: active management option to boost Luxembourg hub

The overhaul of Luxembourg’s securitisation laws introduced a number of changes, notably allowing for active management and a broader [...]

Originator Spotlight/Lenderwize

A fast-growing trade finance platform, Lenderwize specialises in invoice financing in the digital economy. Currently its platform provides its [...]

Digital lending emerges as an important sub-segment of private debt

Amid increasing breadth within the private debt asset class, specialised investors can allocate capital to sub segments in a bid [...]