Will embedded finance shake up the B2B sector?

Consumers have eagerly taken to the introduction of embedded finance, including buy now pay later (BNPL). Experts believe the B2B space is now primed to follow this consumer trend. They predict that B2B companies will make extensive use of embedded finance products and services, small and medium businesses (SMEs) likely to be at the heart of this trend. One reason is that SMEs are already embracing FinTechs, while relationships with banks can be tenuous. Andrew Tierney, Director, Capital Markets & Origination at CrossLend outlines why embedded finance is attractive for businesses, the challenges for profitability, and why private debt investors should be looking at this burgeoning sector.

What is embedded finance? It often involves replacing a two-step process – acquiring funding and then making a purchase – with a single step process, such as having finance availability embedded into the merchant’s platform. “An embedded finance service typically takes away the requirement of interfacing separately with a bank or non-bank lender,” explains Tierney. “it should be a much cleaner, swifter experience for an SME, and less of a burden.”

In the consumer sphere, one of the most common products is buy now pay later (BNPL) – short term interest-free loans that allow online shoppers to pay for a product in roughly 30-60 days. Popular with merchants since it increases basket size and conversion rates, it’s somewhat analogous to credit card debt except it’s the merchants who pay the fees. BNPL is currently being scrutinised by regulators in multiple jurisdictions including the United States, the UK, and the EU.

For businesses, the needs are different. Platforms, apps, and service providers that already have a large proportion of businesses in their customer base have the potential to grow through integrating embedded finance into their model. They can add payment or lending products and services to their offerings, such as factoring or invoice financing.

For example, a merchant could offer BNPL style payment terms to its business clients to increase conversion rates. Similarly, a platform such as an online marketplace could offer instant payouts to merchants. They could even offer overdraft facilities.

Software services that are deeply integrated into businesses, such as enterprise resource planning (ERP), treasury management systems (TMS), or even accounting software, are also seen as possible providers.

The end result may be faster payment cycles. This could help alleviate the typical SME struggle around slow cash flow. It may also reduce reliance on working capital funding. Additionally, it could bring the added bonus of slashing the time businesses spend completing paperwork or even chasing late payments.

“By embedding financial products into their own stack, companies can further monetise their customers with personalised, contextual products, while also increasing retention through a deepening of the customer relationship,” says Michael Jenkins, Strategy Lead at Fidel API. Fidel API is a financial infrastructure platform that enables developers to build on transactions in real-time and trigger event-based experiences.

As an example, “your accounting provider could offer you a lending product when they can see your business needs some extra capital or offer you cheaper financing when business is booming,” says Jenkins.

One reason why smaller businesses in particular are seen as a relevant market for embedded finance offerings is the fact that many smaller businesses are already relying more and more on financial services offered by non-banks, including FinTechs. This trend is driven in part by banks, which are often reluctant to grant unsecured loans to small businesses. According to an analysis by Accenture, only 30% of large banks’ commercial units are achieving sustainable positive returns, with the SME segment specifically underperforming with regard to almost all profitability drivers.

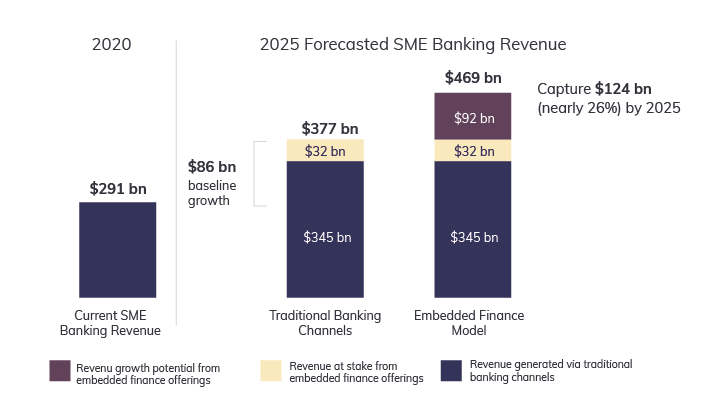

While banks still like to retain these businesses as customers, the reality is that digital challengers can often offer similar services in a more up-to-date package, or add in additional services or functions. For SME customers who still maintain their traditional banking relationships, “many are dissatisfied with or disengaged in their relationship with their bank,” according to Accenture. These customers in particular may be easily convinced to move over to an embedded finance alternative, which could spell trouble for incumbent banks. Accenture estimates that by 2025, “8% of the current SME banking revenue pool will be generated by embedded finance channels.”

A more aggressive growth path could see embedded finance companies unlock additional growth via platform economics, with the potential for embedded finance to capture up to 26% of forecasted SME Banking Revenue by 2025, worth $124bn.

The global market for embedded financial services is projected to be worth $124 billion by 2025,

according to Accenture

Source: Accenture

At the moment, companies are looking to move into this space quickly before the market is saturated, says Mr Tierney. “Within the broader ecosystem, there is the potential for people to move quite quickly, especially through partnerships. If you are a lender, or you provide infrastructure for people to do their own lending through partnerships, you can move quickly to capture market share.”

“For a company that already has a customer base and infrastructure, a product or service, it’s a pretty small step to add that payment option onto their checkout platform.”

“Feedback from the market is that clients are asking for these offerings, so this is market driven,” he notes.

Regulations can be one hindrance, given the novelty of some of the product offerings and often outdated regulations. “When it comes to regulatory hurdles, businesses that already have experience in navigating regulations will have an advantage,” he says.

Investor opportunities

The growth of embedded finance has also created new options for investors, since lenders often need to refinance originations in order to write new loans.

Compared to where investors find themselves today, investing through embedded finance originators in the B2B space may give investors similar or equivalent exposure to traditional SME lending, believes Tierney. “Ultimately it’s a very similar proposition to what they have at the moment, except there is the potential for creating efficiencies in the delivery, so there is the potential for a small increase in yield. But mainly it’s about the market disruption effect, and winning market share. Successful originators in this space will have growing financing needs.”

CrossLend’s product and solution offering, including securitisation as a service, can help with structuring and settlement, including the continual redeployment of funds.

“Within our structure, we can effectively create a structure whereby as short term loans are paid off, capital is quickly redeployed, maintaining your exposure and continuing to earn yields,” explains Tierney.

B2C providers face headwinds

Despite the popularity of BNPL with some consumers, as well as merchants which see increased conversion rates, the reality is that many of the large BNPL players have struggled with profitability in the past year, as they look to grow market share or enter new markets. Three of the largest, Affirm, Afterpay, and Klarna all reported significant losses for 2021 reporting periods.

For the 2021 calendar year, Klarna, Europe’s largest BNPL provider which is also active in the United States, reported credit losses of around $500m on a gross merchant value of around $80bn, meaning a loss rate of around 0.67%, an increase from around 0.52% in 2020. In its 2021 annual report, the Swedish company said its credit loss rates have reduced by over 30% since 2019, with improved underwriting in its mature markets, but cited higher loss rates coming from its expansion into new growth markets with the influx of new customers. “It is more challenging to underwrite a new customer compared to an existing returning one,” said the report.

In the business sphere, there should be a stronger focus on longevity and sustainability from day one, believes Tierney. Embedded finance originators will need to leverage data and sound underwriting principles to generate sustainable growth, he says. “Embedded finance lenders will need to fully leverage open banking regulations so that originators can do proper credit scoring, and it’s not simply a case of fast money.”

For B2B-focused embedded finance players, the key questions will be whether they can avoid high credit losses while maintaining sustainable growth, namely with a tight focus on risk management and building a strong customer base with a reliance on returning customers.

“This is a really important question and very topical given the explosion in BNPL lending more broadly,” says Jenkins.

“Many [consumer] BNPL providers did not have existing relationships with consumers before they lent to them. This is counter to the B2B space where you mostly see companies embedding financial products for their existing customers. Hopefully these long lasting relationships, as well as repeated transactions, will lead to lower credit losses through enhanced risk management processes,” concludes Jenkins.

This article should not be construed as investment advice, or relied upon by anyone as legal, accounting, compliance or tax advice, or for any other purposes. This article is not to be construed, under any circumstances, by implication or otherwise, as an offer to sell, nor as a solicitation to buy securities.

Related articles

Securitisation: active management option to boost Luxembourg hub

The overhaul of Luxembourg’s securitisation laws introduced a number of changes, notably allowing for active management and a broader [...]

Originator Spotlight/Lenderwize

A fast-growing trade finance platform, Lenderwize specialises in invoice financing in the digital economy. Currently its platform provides its [...]

Digital lending emerges as an important sub-segment of private debt

Amid increasing breadth within the private debt asset class, specialised investors can allocate capital to sub segments in a bid [...]