Securitisation 2.0 in Luxembourg

CrossLend’s resident expert on securitisations, Head of Legal Antonine Sanchez, talks about the potential advantages of a securitisation structure for investors, the changes to Luxembourg’s securitisation law including the ability to better incorporate foreign instruments such as German Schuldschein, and the concept of securitisation as a service.

Hi Antonine, can you please give a brief introduction to your professional background and how you came to CrossLend?

Antonine Sanchez: I am a lawyer who qualified to practise in Paris and New York. Before joining CrossLend, I worked several years at the Luxembourg law firm, Elving Hoss Prussen where I specialised in corporate and structured finance and became familiar with Luxembourg securitisation. CrossLend was for me an exciting opportunity to join a young FinTech and to work more closely on the product development and growth of a company while still being involved in the legal structuring and execution of securitisation transactions.

Looking at securitisation, can you please give an overview. What are the main features of a securitisation carried out by CrossLend, and what are some of the reasons to elect for this structure, i.e. what problems can it solve?

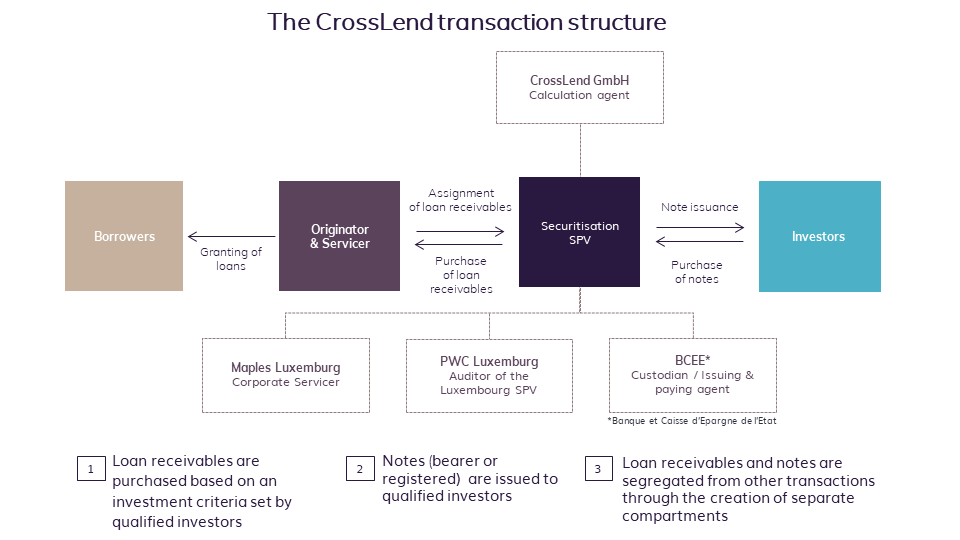

CrossLend securitisation transactions can be structured via two securitisation vehicles, which are both subject to the Luxembourg law of 22 March 2004 on securitisation (the “Securitisation Law”), one is supervised by the Luxembourg regulator, the CSSF, and the other one is unsupervised. The typical CrossLend securitisation structure is shown in the graphic below.

Generally, a securitisation transaction offers several advantages to originators and investors, as it is very flexible with regards to both its structure and features. Originators and investors can determine the transfer mechanism of the underlying exposure into the securitisation vehicle (namely true sale vs. synthetic). Furthermore, the level of continuous involvement of the originator can be customised and hence different levels of derecognition from the books of the originator can be achieved. An investor is able to determine the investment criteria for the securitisation vehicle, the timing of cash flows, underlying exposures and a range of other features relating to the notes to be issued, and thereby customise it to their own specific risk appetite. In addition to SME or residential mortgage loan receivables as indicated on the chart above, the Luxembourg SPV can acquire a wide range of assets such as invoices or grant loans directly (subject to local restrictions in this respect).

CrossLend offers securitisation as a service. Can you speak about the ‘as-a-service’ component? What are some of the advantages for an organisation to work with CrossLend?

Our offering combines a market-standard regulatory and contractual securitisation structure with a data analytics and process automation infrastructure. This means that the legal setup of the transactions follows industry standards in terms of insolvency-remoteness and robustness, and combines this with powerful automation tools for data processing and validation as well as payments processing and reporting. Through this automation we are able to offer competitive prices without any trade-offs on quality. In this respect, where originators and investors are already connected, the parties can utilise CrossLend’s securitisation infrastructure to structure a transaction which meets their specific requirements.

In terms of CrossLend and securitisation, are all securitisations carried out in Luxembourg? Speaking generally, what is attractive about this jurisdiction?

Together with Ireland, Luxembourg is one of the leading centres for securitisation transactions in Europe. Luxembourg has a dedicated securitisation legal framework with the recently amended Securitisation Law. This law has been in place now for 18 years and is a guarantee of legal stability, which is essential to the development of our business.

Another specificity of the securitisation regime in Luxembourg is the possibility to create several compartments within one securitisation vehicle or fund. Compartments are ring-fenced subdivisions of one entity. They correspond to a separate portion of assets financed by the corresponding securities issued by the compartment.

Compartmentalisation offers the possibility to have several securitisation transactions with different investors within the same entity. In addition, the recent amendments to the Securitisation Law brings some welcome clarifications on certain topics (as discussed during our webinar) hence providing even more flexibility in the structuring of cross-border securitisation transactions. For all these aforementioned reasons, it makes sense for CrossLend to operate from Luxembourg.

You mentioned in the recent web session that you’ve got a front seat to the recurring questions from investors but also the blockers when structuring transactions. How complex is securitisation to embark on, what sort of time frame, what should investors think about from the onset?

The investors should think about the underlying exposure/originator in which it wishes to indirectly invest. Once this is decided, the investor should clarify the investment criteria which will apply to its investment (such as maturity of the underlying loans, rating, etc). These investment criteria should also be discussed with the originator. In addition, the investor should determine the timing of the cash flows and whether the notes should be fully pass-through or whether a fixed income feature should be envisaged. Once these points are clarified, the legal documentation can be created and a ring-fenced compartment dedicated to the investor can be created. This process is straightforward and can be completed within a month.

In terms of blockers, what have some of these been? Do they typically result in investors looking for an alternative to a securitisation, or another work around? Does the updated law address these or most of these issues?

Before the amendment of the Securitisation Law, one of the recurring requests from investors was in relation to the funding of the securitisation transaction. Under the old regime, securitisation vehicles had to be financed via the issuance of “securities”. However, we regularly received requests to structure transactions via the issuances of foreign instruments, e.g. Spanish promissory notes, or the German Schuldschein, which is a very traditional instrument, often favoured by German insurance companies and pension funds. For foreign (i.e. non-Luxembourg) instruments, we had to undertake an analysis with local external counsel to check whether the said instruments qualified as “securities” under their governing law. Other investors requested to finance their investment via a loan to the securitisation entity, instead of through the subscription of notes. However, under the old regime, such loan financing was only possible on an ancillary basis. The new Law replaced the reference to “securities” by “financial instruments” hence offering broader refinancing options. A 100% loan financing is also possible moving forward.

This article should not be construed as investment advice, or relied upon by anyone as legal, accounting, compliance or tax advice, or for any other purposes. This article is not to be construed, under any circumstances, by implication or otherwise, as an offer to sell, nor as a solicitation to buy securities.

Related articles

Securitisation: active management option to boost Luxembourg hub

The overhaul of Luxembourg’s securitisation laws introduced a number of changes, notably allowing for active management and a broader [...]

Originator Spotlight/Lenderwize

A fast-growing trade finance platform, Lenderwize specialises in invoice financing in the digital economy. Currently its platform provides its [...]

Digital lending emerges as an important sub-segment of private debt

Amid increasing breadth within the private debt asset class, specialised investors can allocate capital to sub segments in a bid [...]