Digital lending emerges as an important sub-segment of private debt

Amid increasing breadth within the private debt asset class, specialised investors can allocate capital to sub segments in a bid to improve diversification and overall returns. Digital lenders – non-bank lenders that rely on external investors to fund originations – are playing an increasing role in lending to consumers and businesses, and can also provide attractive returns to investors. Investments in digital lender’s originations can benefit from highly granular portfolio construction, with diversification across multiple dimensions including country, risk classes, borrower activity, maturities, and market timing strategies. Nevertheless, high operational costs may preclude many investors from engaging with the sector. One solution is to use data-driven asset sourcing to overcome these obstacles and unlock the opportunities on hand.

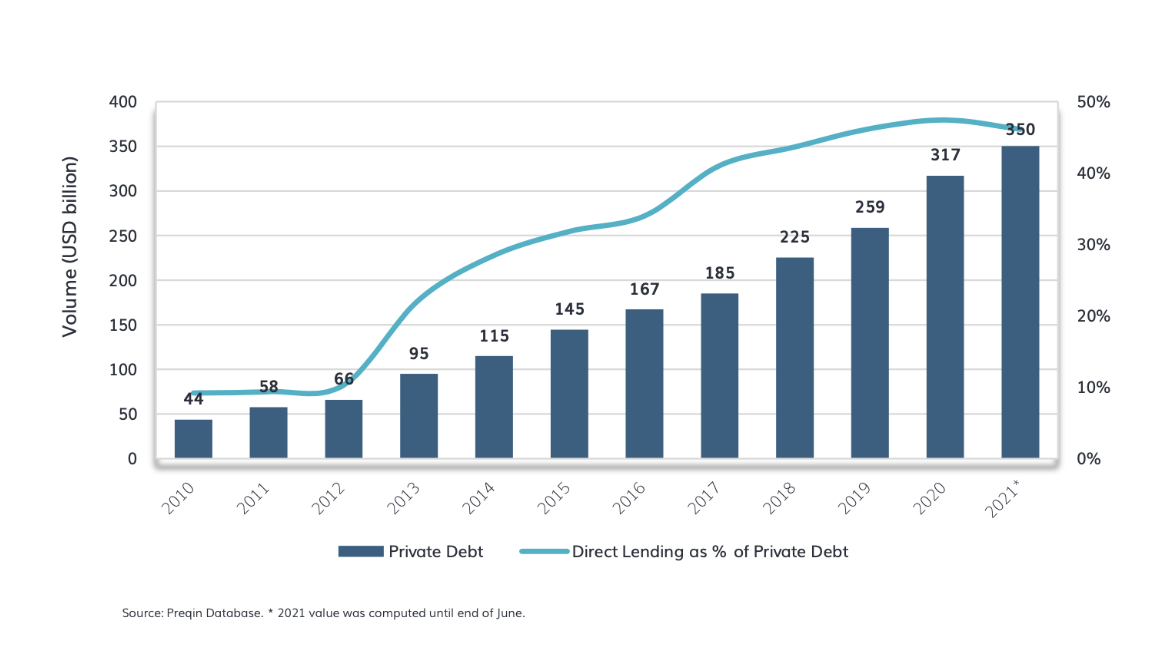

The rapid growth of private debt and credit over the past decade is easily seen in the growth of assets managed by major funds, especially in direct lending. Institutional investors have allocated to the asset class seeking higher yields and diversification within their portfolios.

Against the backdrop of low rates during the past decade, the search for higher yield in private markets easily explained growth in AUMs. Data from Preqin show the AUM of private debt funds in Europe (including the UK) reached $350 billion in 2021, roughly triple the AUM of $115 billion in 2014. Of this, direct lending makes up around 40%.

On the borrower side, demand for financing has been driven in part by the deleveraging of banks, with the non-bank lending ecosystem flourishing as borrowers look to Fintechs, funds and other players to step into the financing gap created by the stricter Basel rules in the aftermath of the global financial crisis.

On the borrower side, demand for financing has been driven in part by the deleveraging of banks, with the non-bank lending ecosystem flourishing as borrowers look to Fintechs, funds and other players to step into the financing gap created by the stricter Basel rules in the aftermath of the global financial crisis.

But apart from the growth in gross AUM, the private debt space has also multiplied in the variety of asset types, capital structures and types of lending.

The result is an asset class – once viewed mainly through a lens of diversification in relation to an overall portfolio – which now presents opportunities for investors to construct highly diversified and granular portfolios within private debt itself.

A recent report noted the wide variety of available assets within the private debt landscape, including direct lending and market lending, factoring and trade finance, CRE debt and infrastructure debt, aviation finance and opportunistic lending, as well as more exotic areas including litigation funding, royalties, and life settlement claims.

It points to private debt as an asset class that is growing increasingly diverse, but one where investors may need a relatively high degree of specialisation to successfully engage with various sub-segments of the market.

At CrossLend, we see the emergence of digital lending as an important sub-segment within the private debt landscape, and one which can help investors achieve greater portfolio diversification as well as offering risk-adjusted returns.

Amid the recent market turmoil, in what is now a rising rates environment, investors are taking a more considered approach to investments based on various features, such as variable rate versus fixed rate, amortising versus balloon, and of course duration.

In this regard, we see originations by digital lenders as possessing a number of attractive features, including the fact that they are often variable rate, may have short terms, and are typically amortising, meaning lower effective duration. That in turn results in originators being able to continually redeploy capital at an evolving spread over benchmark, as well as being selective about their risk capacity according to prevailing credit conditions.

What are digital lenders?

Broadly speaking, digital lending encompasses originations by digitally native lending platforms that target mainly SME and consumer borrowers. In the SME space, the main segments include unsecured working capital, trade finance solutions, factoring, secured lending and real estate.

For borrowers, digital lenders present a financing avenue from where the banks have withdrawn, such as unsecured SME lending, or simply a more agile alternative to banks, with speedier loan approval, digitally-native onboarding, enhanced access such as in embedded finance, and other innovations.

Another important feature is that cost savings on the level of the borrower which – at least partially – are passed on to the borrower as underwriting processes are strongly standardised and leaner than traditional lending business by banks. A 10-times faster credit process is not unusual, which can help explain their fast market acceptance.

Digital lenders, as distinct from banks or traditional finance companies, typically rely on external investors to fund their lending, whether retail investors or professionals. They may have the capacity to directly connect investors with their clients, and in the European Union are often classified as crowdfunding service providers.

In the SME space, the rise of digital lenders has coincided with reduced capacity for banks to adequately service the sector. This is due to a range of factors, but most prominently the increased capital charges attached to riskier lending, and also increased compliance burden, which leads banks to prefer larger ticket loans (though even corporate borrowers can face their own obstacles) due to underlying costs. According to an analysis by Accenture, even as many large banks are struggling to achieve sustainable positive returns in their commercial banking units, the SME segment, specifically, underperforms with regard to almost all profitability drivers.

Hence many digital lenders (and their investors) see themselves as playing an important role in facilitating the sustainability and growth of many small and medium sized businesses that might otherwise struggle to achieve access to affordable liquidity.

Growing maturity

The last decade has witnessed the steady growth and maturation of the digital lending segment, as a wave of companies founded in the years following the global financial crisis have continued to grow and scale up their operations off the back of market acceptance.

Prominent examples including Funding Circle, which has originated loans worth more than $18.4bn to small businesses; Creditshelf, which has originated loans to the German Mittelstand worth close to 450 million euros; and Fellow Bank (formerly Fellow Finance), which has originated loans worth nearly 1bn euros, and recently acquired a Finnish banking licence.

Originators have diverse business models, including those that have a relatively broad set of lending across consumer and business loans, while others are more specialised, such as those operating in the trade finance space.

Many exhibit a high degree of professionalisation, and for example, during the early stages of the Covid crisis, were used by governments in some countries in Europe to distribute loans to businesses.

In Europe most are subject to some degree of regulatory oversight in their home countries, while the entry into the force of the EU Regulation on European Crowdfunding Service Providers (ECSPR) is designed to create a harmonised regulatory framework for crowdfunding platforms in the EU.

Capital needs are growing too

Within the digital lending industry, we see a range of players, including highly mature companies (including some which are listed on public stock exchanges) that have ready access to (funding) capital.

In that respect, a clear trend within the sector is the increasing importance of institutional capital.

Many digital lenders started as peer-to-peer or marketplace lenders offering opportunities for retail investors to fund loans, but as the industry has matured, most have looked to diversify their capital base, or even shifted to relying almost entirely on funding from professional investors rather than retail investors.

Institutional capital is seen as a more stable source of funding, positioning platforms for future growth and allowing them to originate more loans across a broader variety of ticket sizes and maturities, diversifying their loan books. In fact, institutional investors require larger portfolios for refinancing as only this way they can justify internal processes within their investment process.

The opportunity – and challenge – for investors

For investors, investing in or refinancing of digital lending can present both opportunities and challenges.

For one, they are accessing an asset class that was generally not previously available to institutions, implying diversification benefits.

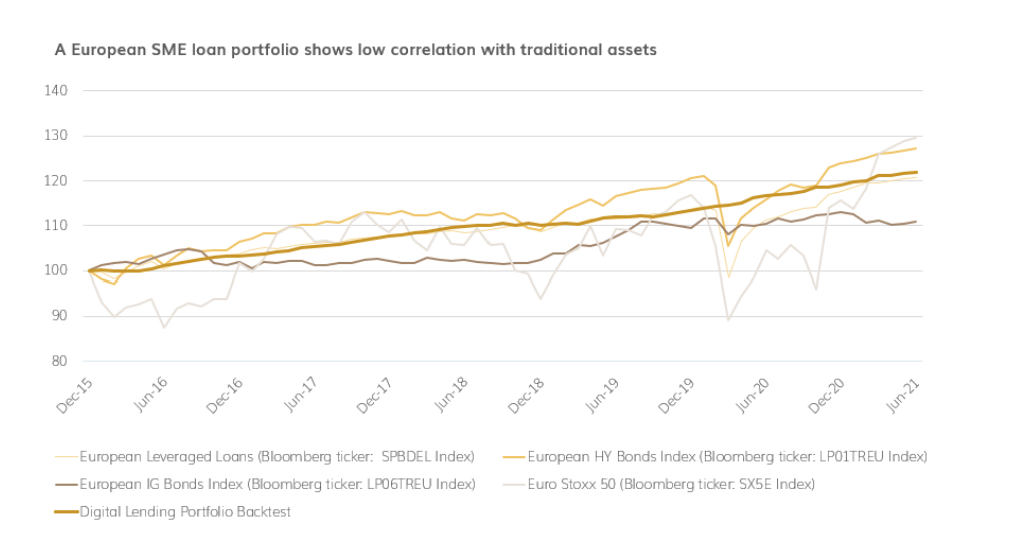

Indeed, according to specific research (please also see graph below) a portfolio of investments in European small and medium enterprise (SME) loans – encompassing working capital loans, trade finance and other similar instruments – shows a very low correlation with the traditional asset classes, including European high-yield bonds, leveraged loans and investment-grade bonds during the comparison period.

Source: CrossLend, Bloomberg

According to this analysis, over the last few years, the correlation of the SME loan portfolio with these aforementioned assets was close to zero, though obviously illiquidity is a factor.

The main factor affecting the pricing or the valuation of this kind of portfolio is the actual behaviour of the underlying loans, namely defaults. That means a portfolio value is expected to remain steady over time if there is no real economic distress. So in this regard, it stands apart as an asset class. Overall, a well-constructed and well-diversified private debt portfolio can be expected to help investors reduce their specific or non-systematic risk.

Illiquidity, amortising, low duration, floating rate are characteristics that reduce private debt exposure to market expectations (namely speculative positioning).

When it comes to yields, most borrowers are seeking an alternative to bank lending, both consumers and businesses, meaning that originators can obtain a spread over standard banking rates. However, the industry is diverse, with some digital lenders applying more conservative approaches. As an example, an investment in the digital lending space could have a target return of 3-year Euro Swap rate plus 500bps p.a., with annualised volatility of 1%.

Nevertheless, there are significant challenges too.

At CrossLend, we’ve been involved in numerous transactions between institutional investors and digital lenders.

Such transactions often have steep operational requirements for investors, including due diligence, compliance, monitoring etc, which may quickly overcome the attractiveness of the segment due to poor cost efficiency.

This aspect is compounded by the fact that there is little uniformity or standardisation by the digital lending sector when it comes to data and data availability.

Therefore, investors can face the dilemma of wanting to deploy capital with fewer platforms in order to reduce operational complexity and costs, while large deployments across just a handful of origination platforms can imply concentration risks.

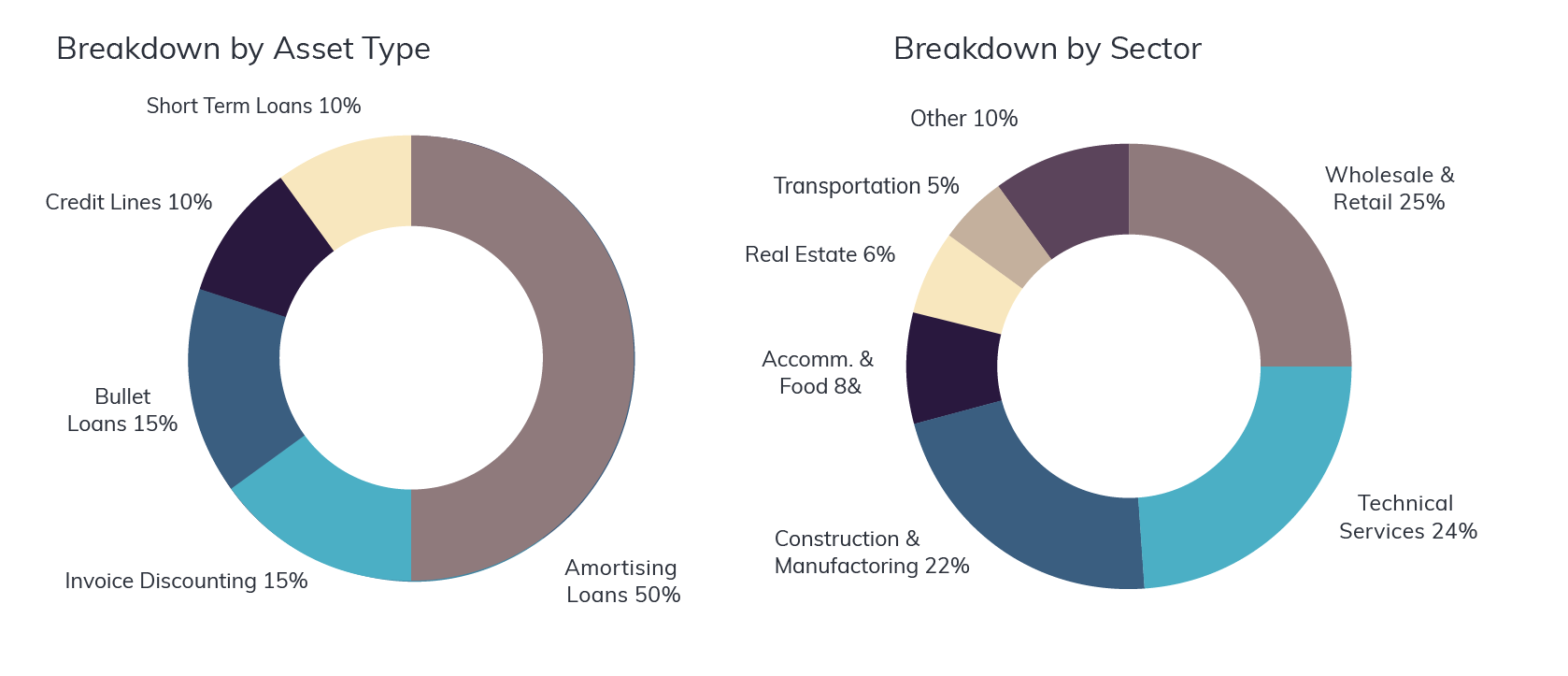

Indeed, looking at digital lending in the SME segment, it is precisely the opportunity to construct highly granular investment portfolios which is one of its most attractive features in terms of diversification.

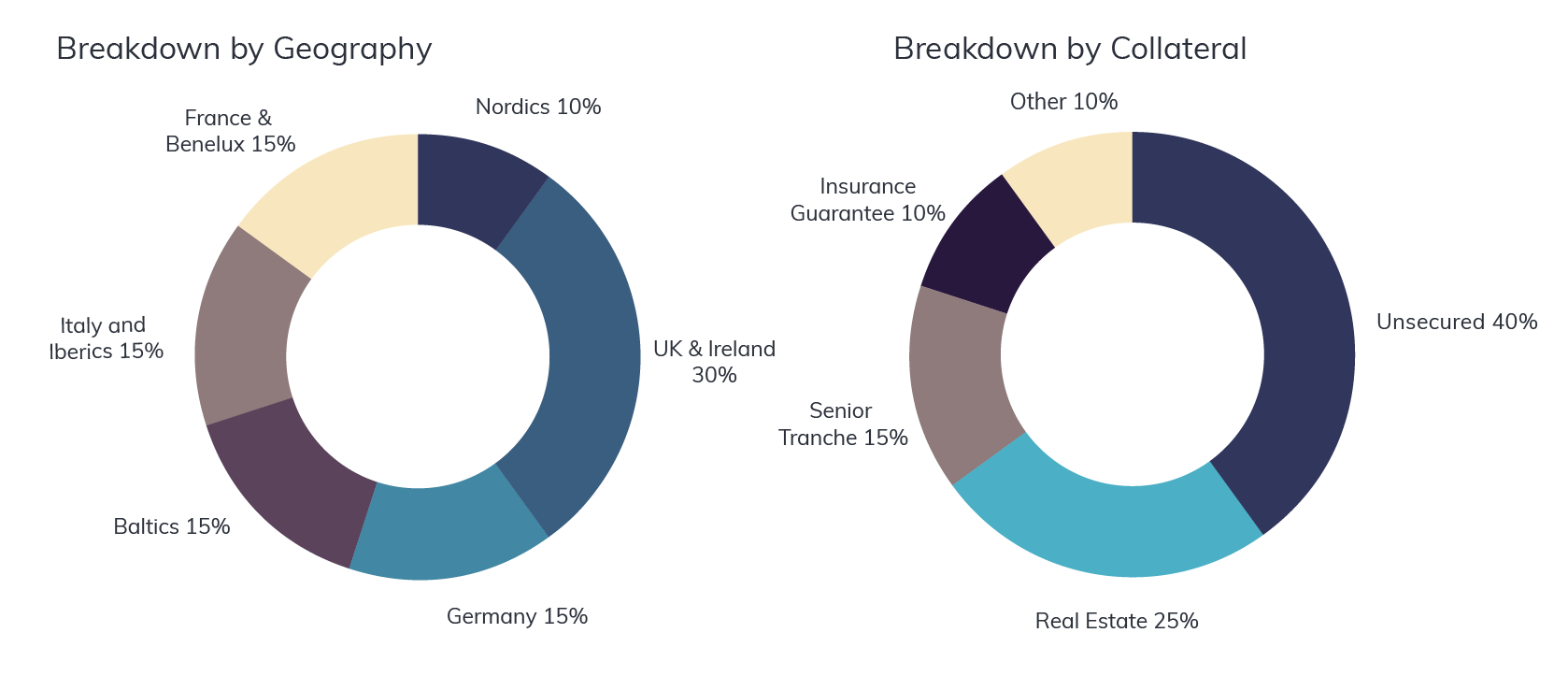

In the SME space, relatively low average ticket sizes of loans allows for the construction of highly granular portfolios, with diversification across multiple dimensions including country, risk classes, borrower activity (NACE classification), maturities, and market timing strategies.

In order to achieve higher geographic diversification, investors will also need to interact with a sufficient number of platforms, since it is recognised in Europe that most originators remain focused on their home markets.

Example portfolio composition of SME loans

Digital solutions to investing in digital lenders

Digital solutions to investing in digital lenders

At CrossLend, with nearly a decade of experience in the private debt space, we believe that technology-driven asset sourcing can be used to overcome these obstacles and unlock the opportunities.

We see deep data, analytics and the application of standardised models as providing a basis for effective construction of highly granular loan portfolios, especially within the SME lending space.

Across Europe there are as many as 700 active digital lenders. But for discerning investors, the pool of viable platforms is in reality far smaller. Even with oversight of regulators, there are significant differences in maturity.

Our experience shows that a qualitative scoring model approach can quickly screen originators, assessing which are worthy of consideration via a more in-depth quantitative due diligence process.

The screening should consider several aspects, such as underlying characteristics, geography, currency, investment horizon, collateral, and governance structure. This provides a first filter, before carrying out deeper analysis, the due diligence, on each digital lender within the selected pool of potentially viable platforms.

Because there are often differences between lenders, especially in areas such as reporting and data, it is essential to have a standardised approach to due diligence, combining experience, hands-on examinations, data ingestion and analytics.

Overall, a holistic approach to due diligence should employ a highly analytical approach to a lender’s book, while also considering a broader basket of risks, such as ensuring that the interests of the investor and the platform are appropriately aligned.

Following deployment of capital, rigorous and on-going monitoring is vital to ensure that the initial conclusions and opinions remain valid. Monitoring should not be limited just to the investor’s own portfolio, but also to the whole portfolio originated by a digital lender, as well as the digital lender’s framework, policies and processes, management team, financial health and regulations.

By helping to improve the efficiency (and reduce the cost) of due diligence and ongoing monitoring, data-driven asset sourcing opens up investment opportunities in smaller ticket sizes, allowing investors access to more granular and diverse portfolios.

In digital lending, an important sub segment of private debt, opportunities are opening up for investors that have the right tools and processes to access them.

This article should not be construed as investment advice, or relied upon by anyone as legal, accounting, compliance or tax advice, or for any other purposes. This article is not to be construed, under any circumstances, by implication or otherwise, as an offer to sell, nor as a solicitation to buy securities.

Related articles

Securitisation: active management option to boost Luxembourg hub

The overhaul of Luxembourg’s securitisation laws introduced a number of changes, notably allowing for active management and a broader [...]

Originator Spotlight/Lenderwize

A fast-growing trade finance platform, Lenderwize specialises in invoice financing in the digital economy. Currently its platform provides its [...]

Digital lending emerges as an important sub-segment of private debt

Amid increasing breadth within the private debt asset class, specialised investors can allocate capital to sub segments in a bid [...]