Private debt ESG investing meets digital debt technology

Well-known in the public debt markets, Environmental, Social, and Governance (ESG) investing in private debt is attractive for investors too. Nevertheless, issues around data and scale can hamper the validation of ESG credentials within private debt. This wasn’t the case in a marquee transaction between Bikeleasing and MEAG, facilitated by CrossLend’s securitisation platform, which received a green bond designation from a rating agency.

Discussing key elements of the transaction and the underlying digital debt technology, Thomas Bayerl, Head of Illiquid Assets Debt at MEAG, and Patrick Janz, General Manager of Hofmann Leasing GmbH (within Bikeleasing Group) spoke with Jochen Weiss, Director Regulatory and Accounting Solutions at CrossLend.

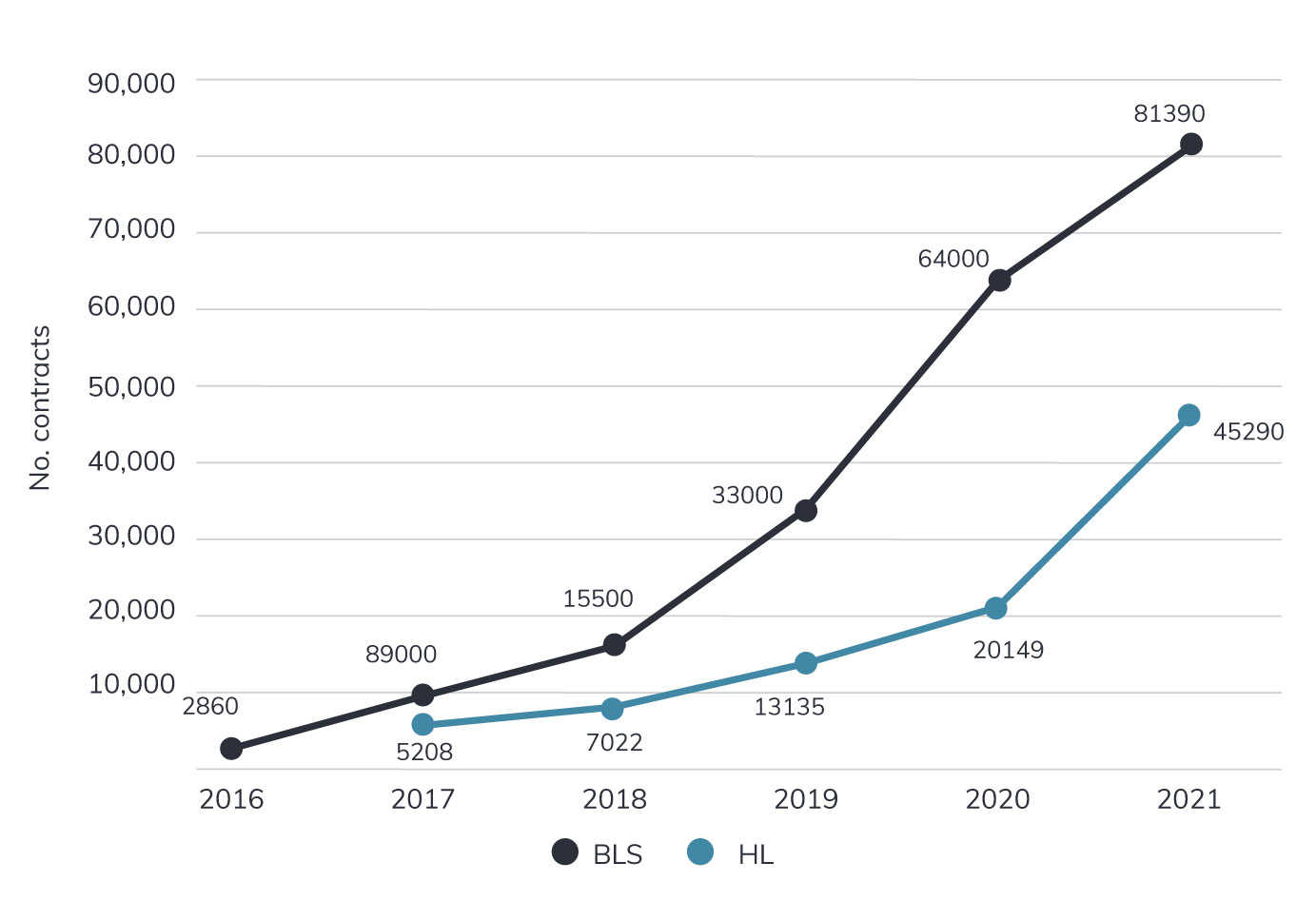

Why lease a bike? For employees and self-employed workers, there can be substantial tax savings in Germany, as high as 40% compared with simply purchasing a bike outright, explains Patrick Janz, General Manager of Hofmann Leasing GmbH (within Bikeleasing Group). Bikeleasing was founded in 2016 and has seen meteoric growth since then, from 2,800 leasing contracts in its first year, up to more than 80,000 contracts as of 2021. These are sold via two channels: through Bikeleasing’s own platform and also via an external leasing company.

How does the Bikeleasing platform differentiate itself from its competition? its user-friendly platform offers a slick end-to-end digital process, with its own IT portal and mobile app. The company offers a powerful damage insurance package, including own claims settlement and all round protection for the employer. For example, if the employee retires, gets sick, or quits during the leasing period,this protection would apply, explains Janz. The standard leasing term is 36 months, after which the employee has the option to purchase the bike outright for 20% of the original listing price, which most do.

In 2020, Bikeleasing expanded into Austria. The company is also eyeing an expansion into additional markets in Europe. Nevertheless, their primary focus is now on increasing penetration into Germany and Austria, to leverage their existing relationships with businesses.

“Our current goal is to increase pickup rates within the organisations where we already have relationships,” explains Janz. “We have around 30,000 onboarded companies where employees have already used our service.”

Total number of bike leasing contracts closed by Bikeleasing and Hofmann Leasing (part of Bikeleasing group)

In terms of ESG, Bikeleasing’s product has a clear sustainability component. Employees who receive a bike can use it for their daily commute and also in their private time. That reduces the miles driven by internal combustion engine vehicles, limiting greenhouse gas emissions and improving air quality. There are also other benefits, with studies showing that employees who cycle to work are healthier, happier, and even more productive, since they are less likely to call in sick.

Bikeleasing’s fast growth has led the company to look for refinancing options beyond what is available via their existing banking relationships. In 2021, its leasing volumes exceeded 200 million euros. “In 2022 we are targeting a growth rate of above 20%, and we need options to refinance our existing leases outside of banks,” said Janz.

This is the point at which MEAG, which acts as the asset manager for ERGO and Munich RE, entered the scene. The connection was fortuitous – Bikeleasing is an insurance client of ERGO, and a discussion had evolved around supporting the continued growth of an important client.

The transaction fell under the remit of Thomas Bayerl, Head of Illiquid Asset Debt at MEAG. With an investment mandate for illiquid assets debt, Bayerl’s main focus is the financing of infrastructure debt transactions, as well as various private debt investments.

For Bayerl, it was clear that the most suitable way to carry out a refinancing of Bikeleasing’s leasing receivables was via a securitisation platform. “As MEAG has no securitisation platform in house, we required someone external to support us and to help us with setting up this platform,” he said.

A survey of the market, and a recommendation of a fund manager, led them to CrossLend’s door. “After the first conversation with CrossLend, it was apparent that their Securitisation as a Service platform was the model which we were looking for and which could support us in this deal, since securitisation as a service is one of CrossLend’s core business activities,” said Bayerl.

Digital tech tokenisation

For Bayerl, one key advantage of CrossLend’s technology was that it could tokenise each individual cash flow of the leasing business. This would enable a high degree of flexibility in the structuring processes and allow a fine-grained analysis of the credit risks and of the assets themselves.

“From our perspective, it is very important to utilise a platform which offers sufficient flexibility in providing diverse structures because different investors have different appetites. It should also allow for potential growth in the future. Hence, we see the CrossLend platform as being highly suitable for catering to different risk profiles, in terms of credit risk, duration, and so forth.”

With regard to the investment rationale, the investment in bike leasing receivables would provide good diversification for investors’ existing portfolios, noted Bayerl. Meanwhile, the investment itself would be highly diverse given that it would cover a high number of customers (namely the businesses) entailing a significant number of different industry sectors, as well as offering a large quantity of bikes with high utilisation.

“This approach provides flexibility when it comes to structuring the product, which can then offer the investor – in this case, ERGO – a very good risk return profile,” explained Bayerl. “Furthermore, we liked the fact that we are able to invest in a very green business case, this was part of the overall motivation.”

Somewhat unusually for a private debt transaction, the note received a rating from a rating agency. Berlin-based Scope Ratings was selected for its knowledge of the German market to carry out the ratings activity.

As the structurer of the note, CrossLend carried out discussions with the ratings agency and provided the credit analysts with the required information.

“During the process, CrossLend was very supportive,” says Bayerl. “It was also quite good for myself as an investor that I had to put in less effort than can be the case when utilising other services in this space.”

Scope Ratings assigned the note an investment grade rating (BBB-), which gave rise to convenient regulatory treatment for the investing insurance companies in Solvency II terms.

The rating agency also opined on its green credentials, delivering a second party opinion (SPO) that the note was aligned with the 2021 Green Bond Principles (GBP) issued by the International Capital Markets Association (ICMA). According to Scope Ratings’ SPO, the investment would indirectly save more than 13,000 tons of C02 per year, compensating the per capita emission of 1,600 citizens in the EU per year. CrossLend provided the framework for the issuance and the related overall SPO assessment.

The transaction was initiated early in the summer of 2021. “The ramp-up is even stronger than anticipated, which we are very pleased about because deploying the funding even earlier in the transaction means we begin to receive the coupon and the yield sooner, which is very crucial and important to us as an investor,” said Bayerl.

High-level overview of the transaction

DLT-like solution

CrossLend’s Securitisation as a Service platform (SaaS) offers a solution that bears comparison with features that are common in the distributed ledger technology (DLT) or blockchain space.

To create a digital asset, there are two main components. One is a data link that connects all relevant data from a loan or a receivable to a unique combination of letters and numbers, which is then the token, explains Jochen Weiss, Director Regulatory and Accounting Solutions at CrossLend.

All relevant and available information is then mapped to this token, such as maturity, currency, origination data, and so forth.

The second component is the decision about how to store this information. Whether this is done on a USB stick, a public blockchain, or on a permissioned ledger is to some degree trivial. What matters is that through this data link to this specific token,the digital asset has been created, with multiple possibilities of use.

The information can be detached from the actual contract and the risk related to that asset can be moved to specific investors, offering opportunities to create a liquid investment with the characteristics of a private debt asset.

“Overall, we see the tokenisation of traditional assets steadily increasing in Europe, and we expect that in the next few years, the volume will be significant in relation to the overall securitisation space,” said Weiss.

In terms of the structure of the note, a Luxembourg-based securitisation company, Debt Marketplace SARL, provides the central element of the structure. It issues a note to the investors and receives funds in return, refinancing the purchase of the lease receivables which are then physically transferred into the Special Purpose Vehicle (SPV).

For this transaction, the originator remains the servicer of the lease receivables, stays client facing, and makes sure that payments are processed as scheduled.

“As an asset manager, we work in an environment where digital transformation and sustainability criteria play an increasing role in the development of investable assets. CrossLend’s digital asset platform and register were instrumental in making this asset accessible for our client, ERGO. This transaction can serve as a successful example for further implementation possibilities in a variety of industries,” concluded Bayerl from MEAG.

According to Weiss, the utilisation of digital assets in the securitisation space is set to continue its fast growth in Europe in the coming years.

“This marquee transaction demonstrates the value of technology in unlocking opportunities for investors in the debt capital market space. Transactions can be structured in a format that is beneficial for investors in relation to their reporting, compliance, and regulatory capital requirements, not to mention with a heightened efficiency of operation. The result is a greater interlocking of investors and the private sector, helping businesses such as Bikeleasing to sustain their growth and also contribute to a reduction in greenhouse gas emissions.”

Related articles

Securitisation: active management option to boost Luxembourg hub

The overhaul of Luxembourg’s securitisation laws introduced a number of changes, notably allowing for active management and a broader [...]

Originator Spotlight/Lenderwize

A fast-growing trade finance platform, Lenderwize specialises in invoice financing in the digital economy. Currently its platform provides its [...]

Digital lending emerges as an important sub-segment of private debt

Amid increasing breadth within the private debt asset class, specialised investors can allocate capital to sub segments in a bid [...]